RSA: SDL Contribution Holiday

Employers who are registered for SDL are exempt from the SDL liability and payment from 1 May 2020 – 31 August 2020.

As from the first pay period in September you need to set the SDL Percentage back to one percent.

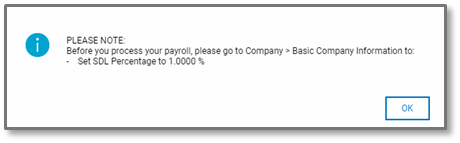

When you do a Start of Period into September or into the first pay period of September (non-monthly companies), you will get a message instructing you to do so:

Please access the Basic Company Information Screen in the first processing period of September and enter the SDL Percentage as 1.00%.

The Period SDL Calculation must, however, remain selected (ticked) for the rest of the year.

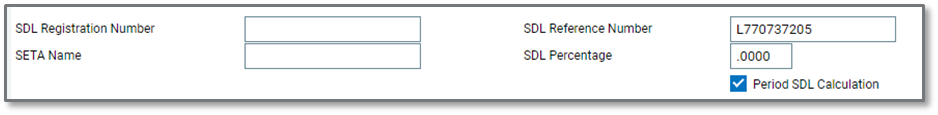

Basic Company Information Screen

Main Menu > Company > Basic Company Information Screen

-

SDL Percentage: Change to ‘1.0000’.

-

Period SDL Calculation: This option will remain visible for now (and not only when <Invite Consultant> has accessed your system). Leave this option selected (ticked) for the rest of the Tax Year to ensure the YTD Skills Development Levy is calculated correctly.

If you have not set the SDL Percentage to 1% in September, or in the first pay period of September (non-monthly companies), you will need to:

-

calculate the value for the missed pay period(s) manually,

-

capture these values on the Employee Company Contribution Screen on the SDL line, in the Amount column,

-

times by 1.

You could also do this input via a Batch.

This will ensure that YTD SDL contributions are correct.